Top Guidelines Of Paul B Insurance

Whether you have a bronze health plan, a high-deductible wellness plan, or a Medicare Component C strategy, they will all fall under these standard categories. We'll describe the main sorts of medical insurance and also examples. One of two primary types of wellness insurance coverage, public health insurance policy is offered via a government program, like Medicare, Medicaid, or CHIP.

Much like private health insurance coverage plans, which we'll discuss next, government medical insurance programs try to handle top quality and costs of care, in an effort to supply lower prices to the guaranteed. All medical insurance strategies are made to aid you save money on healthcare expenses. Individuals with this sort of insurance policy are still in charge of costs of care, like premiums, deductibles, as well as various other out-of-pocket expenses They might not be as high as with various other kinds of insurance coverage.

Medicaid and also CHIP are run by each state. While there is no enrollment duration, there are economic needs to certify. You can begin with this state-by-state overview to Medicaid. Discover more about exactly how medical insurance functions. Any health and wellness insurance coverage that's not received with a federal government program is considered personal medical insurance, the other primary kind of health and wellness insurance.

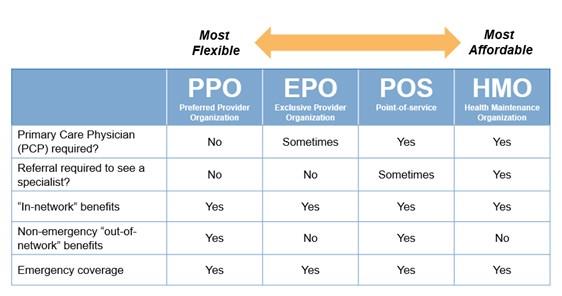

After you've identified the primary kind of health and wellness insurance policy based upon its resource, you can better categorize your coverage by the sort of plan. Many medical insurance plans are taken care of treatment strategies, which merely means the insurance provider deal with different medical carriers to develop and also negotiate costs and high quality of care.

Some Ideas on Paul B Insurance You Need To Know

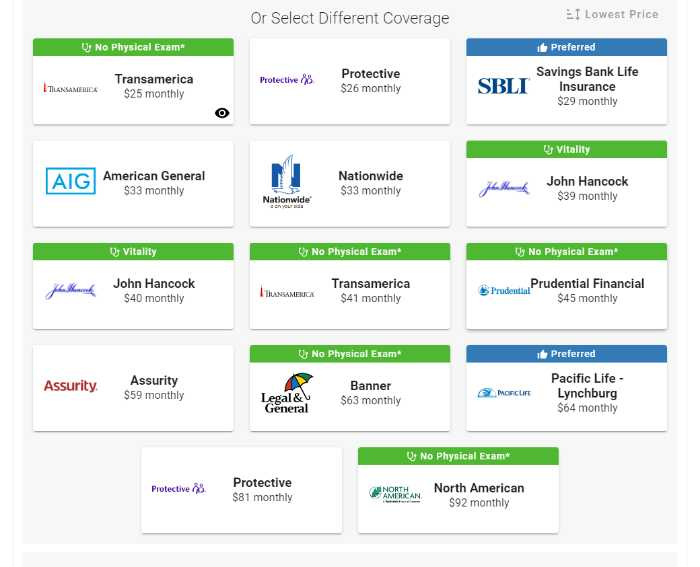

The deductibles, and also various other out-of-pocket expenses like copayments and coinsurance for a health insurance will certainly differ based upon your insurer and just how much care you seek. A high-deductible health and wellness strategy (HDHP), which allows the guaranteed person to open an HSA account, might be an HMO with one insurance company, as well as an EPO with an additional.

Still, picking health and wellness insurance can be effort, also if you're choosing a plan via your employer. There are a whole lot of confusing terms, as well as the procedure pressures you to think difficult regarding your wellness and your financial resources. Plus you need to browse all of it on a target date, typically with just a few-week duration to discover your options and choose.

Asking on your own a couple of straightforward questions can help you no in on the ideal strategy from all those on the marketplace. Below are some tips on where to look and exactly how to get credible suggestions and also help if you need it. It's not constantly obvious where to search for medical insurance.

, where you can go shopping for insurance in the markets developed by the Affordable Care Act, also recognized as Obamacare.

Indicators on Paul B Insurance You Need To Know

Also with dozens of options, you can tighten things down with some standard inquiries, De, La, O states. If you're quite healthy, any of a variety of strategies could function.

Occasionally you can go into in your medicines or doctors' names while you look for plans online to filter out strategies that won't cover them. Is my medication on the strategy's formulary (the list of drugs an insurance coverage plan will cover)?

A Health care Company often tends to have a strict network of companies if you see a service provider outside of the network, the costs are all on you. A Preferred Company Company "will certainly provide you a whole lot more comprehensive selection of carriers it could be a little more expensive to see than an out-of-network company, yet they'll still cover some of that price," she discusses.

If you picked that strategy, you would certainly be wagering you won't have to make use of a whole lot of wellness solutions, as well as so would only need to bother with your ideally budget friendly costs, as well as the costs of a few consultations. If you have a persistent medical problem or are merely more risk averse, you could rather select a plan that has called up the quantity of the costs.

How Paul B Insurance can Save You Time, Stress, and Money.

In this way, you can most likely to a whole lot of consultations as well as choose up a lot of prescriptions and still have convenient month-to-month expenses. Which strategies are offered and cost effective to you will vary a whole lot depending upon where you live, your revenue as well as that's in your family and also on your insurance plan.

Still really feeling overwhelmed with all the ACA selections? There is totally free, neutral professional help offered to assist you pick and also register in a plan. Aaron De, La, O is one such navigator, and keeps in mind that he as well as his fellow guides don't work on commission they're paid by the government.

gov or your regional state department of Get More Information insurance coverage to locate someone that's licensed and in good standing." The internet can be a frightening location. Corlette states she cautions people: Don't put your call details in medical insurance interest forms or click on-line ads for insurance! The plans that often her responsevisit tend to appear when you Google "I need medical insurance" can seem enticing due to the fact that they're commonly extremely low-cost however they might additionally be "short-term" plans that do not cover standard things like prescription drugs or yearly check ups.

"Unfortunately, there are a great deal of disadvantage artists out there that take advantage of the truth that people identify wellness insurance policy is something that they need to get," claims Corlette. She tells people: "Just go directly to Healthcare.

Paul B Insurance for Beginners

This year, the register duration for the Wellness, Treatment. gov industry intends that enter into effect in January 2022 starts Nov. 1, 2021 and runs until Jan. 15, 2022. If you're registering for an employer-sponsored strategy or Medicare, the deadlines will certainly be various, however most likely likewise in the autumn.